Why Lithium Carbonate and why Lithium Hydroxide?

A news report prominently shows impressive footage of 4 FUNDABAC® Filter Systems. (0:17 min & 0:50 min)

The increased demand for lithium

As the insatiable demand for energy coupled with ever our increasing need for mobility continues at a furious pace, so too grows the demand for lithium compounds. Demand from the lithium battery market from all applications including mobile devices like mobile phones and tablets, e-bikes, hybrid and electric vehicles and large scale energy storage is growing at an astounding rate. Deutsche Bank believes we are at the dawn of a new automotive era with “unprecedented technological and regulatory change set to come in the next 5 years.”

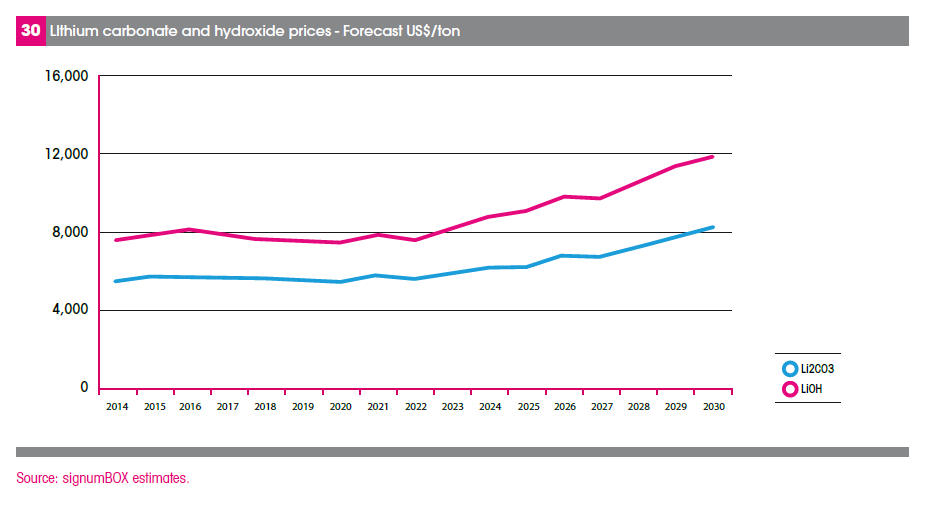

Many analysts acknowledge that batteries use will drive lithium demand in the future. It has been predicted that overall, lithium demand will more than double from present levels through 2025. Currently there is insufficient supply due to fewer than expected producers of lithium. The general conclusion is that lithium prices will rise, particularly, battery grade lithium carbonate and lithium hydroxide should see strong price increases.

Tesla Motors, LG Chem, Boston Power BYD and Foxconn are building battery supper-plants that will come on-stream in the next one to two years. The new supply could revolutionise how we source and use energy, creating a once-in-a-century disruptive event. Last year, the world produced 35GWh worth of battery cells. Total new capacity of 87 GWh should require an additional 70,000t to 100,000t of LCE [lithium carbonate equivalent] by 2021, this supply currently does not exist and requires new producers to come on stream.

Up until very recently lithium carbonate has been the focus of many producers for battery applications. This is because existing battery designs called for cathodes using this raw material. This is about to change. Supply of lithium hydroxide, which is also a key battery cathode raw material, is far less than lithium carbonate at present. It is a more niche product than lithium carbonate, but is also used by major battery producers that are competing with the industrial lubricant industry for the same raw material. Lithium hydroxide is subsequently expected to be in an even shorter supply situation to its carbonate counterpart.

Key advantages of Lithium Hydroxide Battery Cathodes vs. Other Chemical Compounds include better power density (more battery capacity), longer life cycle and enhanced safety features.

Battery grade lithium hydroxide prices are in the range of US$8,375/t to US$8,700/t. In Korea and Japan battery grade lithium hydroxide sell from between US$8,800 to US$10,500. Both Japan and Korea are known to produce high quality lithium batteries. SignumBox forecast the price of lithium hydroxide to steadily increase reaching US$12,000/t by 2031.

Leaders such as Tesla have selected lithium hydroxide batteries for their vehicles. Other auto manufacturers are using designs which can easily switch from lithium carbonate to lithium hydroxide in the future. This is a likely scenario given lithium hydroxide can provide better power density and thereby range.

The battery chemistry is all about range and energy density. This is really game-changing technology. If batteries are the holy grail of the EV, then energy density is the holy grail of batteries and this will come down to the raw materials used.

Why DrM’s FUNDABAC® filtration system?

This all helps to explain the upsurge of companies seeking to build high purity Lithium Hydroxide plants similar to the two streams under construction in Western Australia for the Chinese company Tianqi. DrM have supplied a range of FUNDABAC® polishing and guard filters for various extraction and purification steps for these two streams.

The fully automated DrM FUNDABAC® filtration systems were selected by Tianqi following their experience with the long-term reliability and ease of operation that has been demonstrated with the FUNDABAC® filters in operation with Tianqi in China on their Lithium Carbonate plants since 2010. This experience gave Tianqi the confidence that the FUNDABAC® technology was the best available technology for the strategically important new high purity Lithium Hydroxide plant in Western Australia. In the meantime a number of orders with other clients both in North and South America have been secured.

We are actively working on a number of other hard rock (Spodumene) Lithium extraction projects in Australia, as Spodumene offers a more direct refining route to Lithium Hydroxide than brine processing. Processing brine comes directly to Lithium Carbonate, but should not be ignored in the long term as it is still used and will continue to be used for the cathodes in most current battery technology and the lithium carbonate can be converted to lithium hydroxide and the predicted demand and pricing is expected to keep this an economically viable route.

From our SEA base we are working together with the potential Lithium Hydroxide refiners and specialist engineering companies for mineral processing to help develop the various different extraction process required for the various Spodumene geologies. Our hope and target is to be providing further FUNDABAC® process and guard filters to the new plants that are currently in the planning and feasibility stages.

A major contribution to the world lithium market has come from Australia, the country currently being the biggest influencer, with Chile coming a close second.

Trackbacks & Pingbacks

[…] https://drmgroup.com/why-lithium-and-why-lithium-hydroxide/ […]

[…] Find out more about our filter in regards to lithium extraction: https://drmgroup.com/why-lithium-and-why-lithium-hydroxide/ […]

Comments are closed.